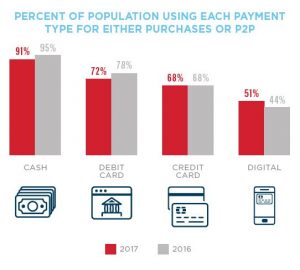

Cash is still one of Americans’ favorite methods of payment for purchases. While it scored behind debit cards in the September 2017 Cardtronics Health of Cash study, cash remains the most commonly used form of payment, with 91% of respondents saying they had used cash in person-to-person payments in the last six months. That’s an uptick from 89% a year earlier.

This compares to 72% of survey respondents who used debit cards, 68% who used credit cards, and 51% who used digital payments such as mobile wallets, P2P apps and retailer apps. “Cash, which notably remains the most commonly used form of payment, continues to play a meaningful and often leading role among the full range of cash, card and digital payment options. Merchants (grocers, convenience stores, pharmacy, small/local businesses, and mass merchants) also prefer cash payments,” according to a NACS blog about the study.

Interestingly, cash wasn’t the preferred form of payment. That distinction went to debit cards, named by 33% as their preference. But cash scored higher (27%) than credit cards (22%), electronic payments (15%) and checks (3%).

Nevertheless, consumers want the choice of paying with cash. The study found that 89% of respondents like having payment method choices and 61% “get upset when establishments don’t accept cash.” And for about 7% of the U.S. population that has no bank accounts – about 9 million households – cash may be the only option for completing transactions. Worldwide, the number of “unbanked” is 2 billion, roughly 20% of the population.

Security and Convenience

Aside from the unbanked, using cash has a lot to do with convenience, but that isn’t the whole story. Security plays a big role as well. “After convenience, people continue to be highly concerned about payment safety, with 84 percent describing themselves as worried about data security,” Tom Pierce, Cardtronics Chief Marketing Officer, said in a news release.

Cash topped the list when respondents were asked to name the safest way to pay, as well as the payment method that bests protects their privacy, Pierce said. Cash is still so prevalent, the study found, that two-thirds of respondents (67%) feel nervous when they have no cash on them.

The Cardtronics survey reinforces earlier research about the dominance of cash. For instance, the Federal Reserve’s State of Cash study in 2015 found that cash was “the most frequently used consumer payment instrument.”

Cash is Here to Stay

Despite cash’s dominance, the debate about whether to move toward a cashless society rages on. A recent Wall Street Journal column, for instance, argued that getting rid of higher-denomination bills – $50 and $100 – would help reduce crime by cutting down on the “underground economy” and, in the process, also reduce tax evasion. Since most people don’t use the larger bills anyway, the author argued, few would notice their absence.

The column fell short of arguing for a totally cashless system, though that is what some cashless advocates would like to see. Proponents argue that cashless payments add convenience and help consumers better track their purchases – arguments that also are used in favor of using cash.

In the United Kingdom, The Bank of England’s Chief Cashier, Victoria Cleland, also recently commented on the cashless society controversy saying: “The end of notes has been predicted for decades, first with the rise of bank cards and now the internet revolution.” She continued that “for consumers, a key benefit of cash is its tangibility. It can be a useful budgeting tool, and it is a quick and easy payment method which works even when, for example, card terminals do not.”

The bottom line is a cashless society isn’t likely to become reality so long as consumers continue to demand choice in forms of payment. The Cardtronics study found that 82% of respondents would miss cash if it disappeared. That is a solid majority – and it proves that no matter how much talk there is of replacing cash with other forms of payment, consumers simply aren’t ready for that. And that means cash is here to stay.